At Ally Dakota Development, we specialize in helping local businesses secure SBA loans and other financing solutions. As a Certified Development Company authorized by the U.S. Small Business Administration, we make funding simple and accessible to support your business growth—whether you’re looking to:

With low down payments and long-term, fixed-rate loans, you can invest in your business’s future with confidence.

FUNDED AND IT FEELS SO GOOD – Congratulations to Dairy Queen Grill & Chill in Hartford, SD! Ally Dakota Development partnered with First National Bank (Pierre, SD) to finance the

42nd Annual Celebration – East River Last week, we gathered at Schade Vineyard & Winery in Volga to celebrate 42 years of impact in South Dakota – and what a

FUNDED AND IT FEELS SO GOOD – Congratulations to Run Wild! Ally Dakota Development partnered with Black Hills Community Bank (Rapid City, SD) to finance Run Wild’s purchase of the

From breakout sessions to beachside bonding, our team had an incredible week last week in Ft. Lauderdale attending the National Association of Development Companies – NADCO Annual Conference! NADCO always

We’re excited to honor Luke Enos of Black Hills Community Bank (Rapid City, SD) as our west river 2025 Lender of the Year! Luke shared that partnering with Ally Dakota

FUNDED AND IT FEELS SO GOOD – Congratulations to SunMasters Auto Glass! Ally Dakota Development partnered with First Dakota National Bank (Pierre, SD) to finance the purchase of the building

FUNDED AND IT FEELS SO GOOD – Congratulations to Smyth Automotive! Ally Dakota Development partnered with Dacotah Bank (Custer, SD) to finance the purchase of a building along Highway 16

Last week, we gathered at Hay Camp Brewing Company in Rapid City to celebrate 42 years of impact in South Dakota! Highlights of the event include: Lender of the Year

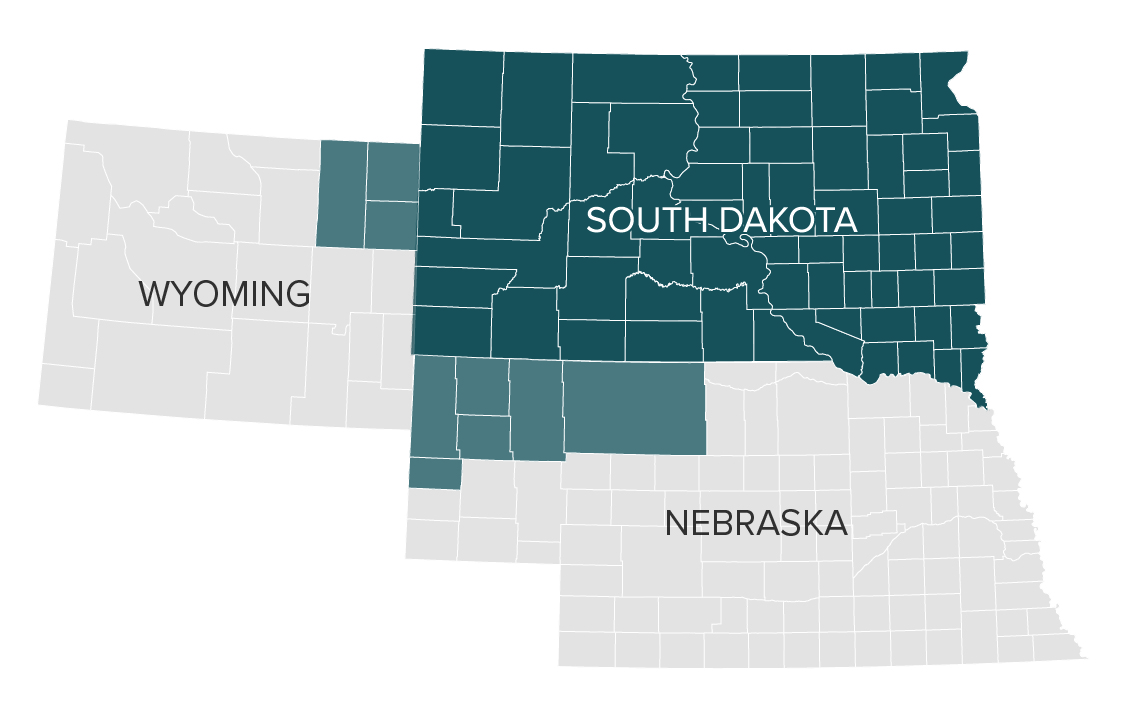

Ready to deepen your SBA 504 expertise? Ally Dakota Development, a certified development company, has been an SBA 504 lender since 1983. Our roots run deep across South Dakota. Our

Future Difference Maker in Business! Congratulations to our 2025 Scholarship Recipient, Joshua Thorson! A proud Northwestern Area High School grad, Joshua is headed to Dakota State University to pursue a

Future Difference Maker in Business! Congratulations to our 2025 Scholarship Recipient, Corbin Winquist! A proud Canton High School grad, Corbin is headed to the University of South Dakota to pursue

Future Difference Maker in Business! Congratulations to our 2025 Scholarship Recipient, Makia Moe! A proud Deuel High School grad, Makia is headed to South Dakota State University to pursue a